Grow Wealth.

Keep Control.

A beautiful, private and open-source investment tracker that runs locally on all your devices.

Loved by the open-source community

Your wealth,

your rules

Wealthfolio works locally on your desktop, mobile, or self-hosted web server. No account needed. Connect is an optional subscription for brokerage sync and multi-device access.

Runs entirely on your devices

Inspect, fork, run your way

No limits on portfolios

Features

Everything you need to track your wealth

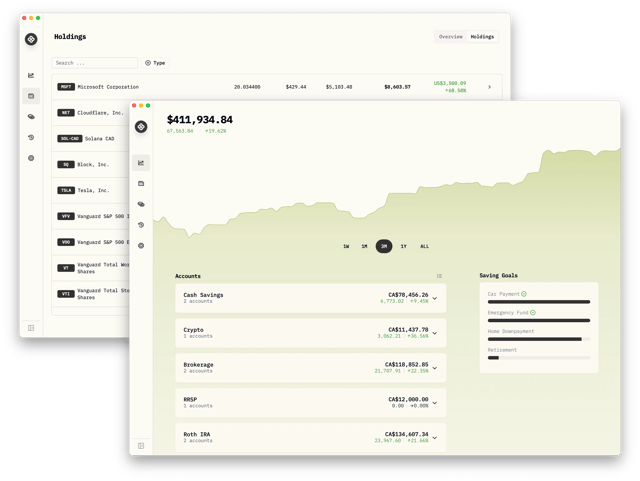

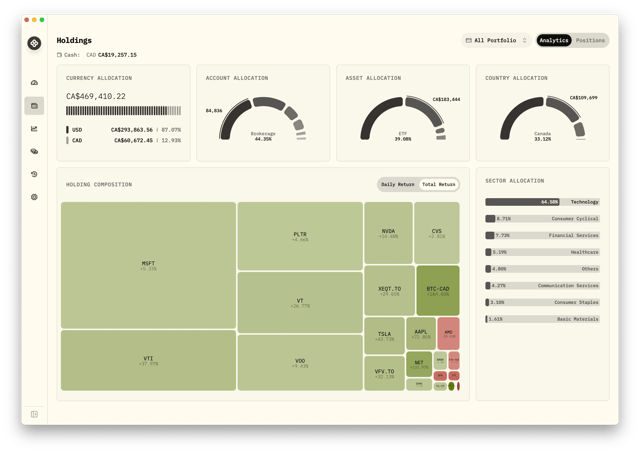

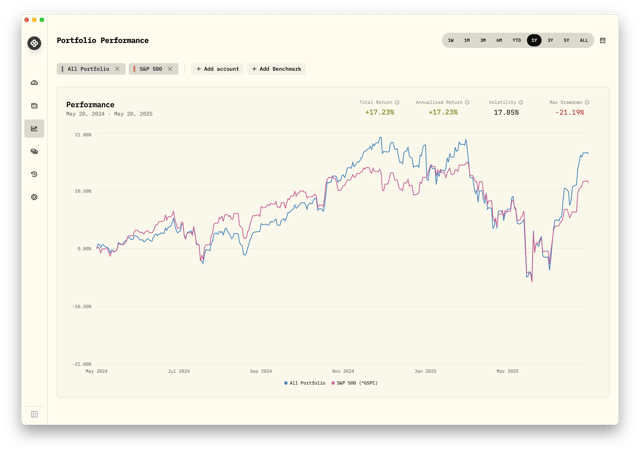

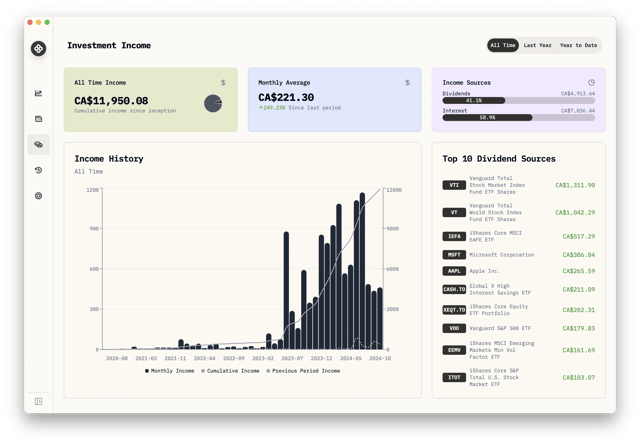

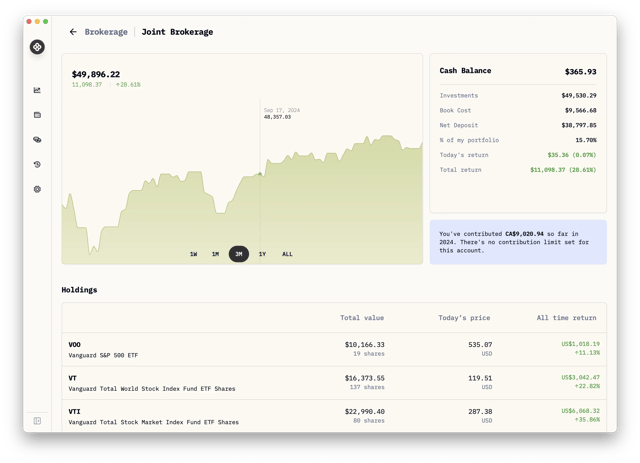

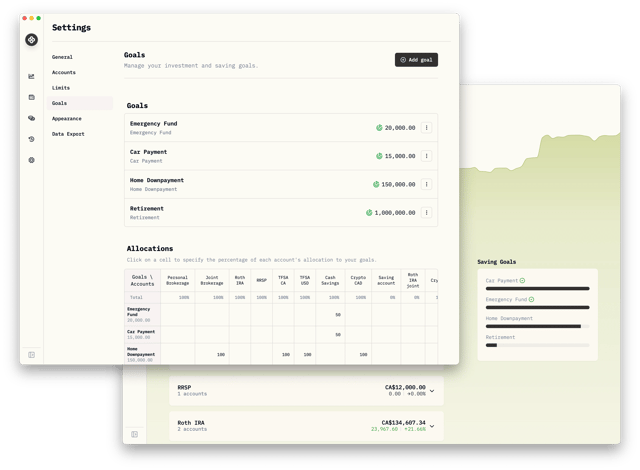

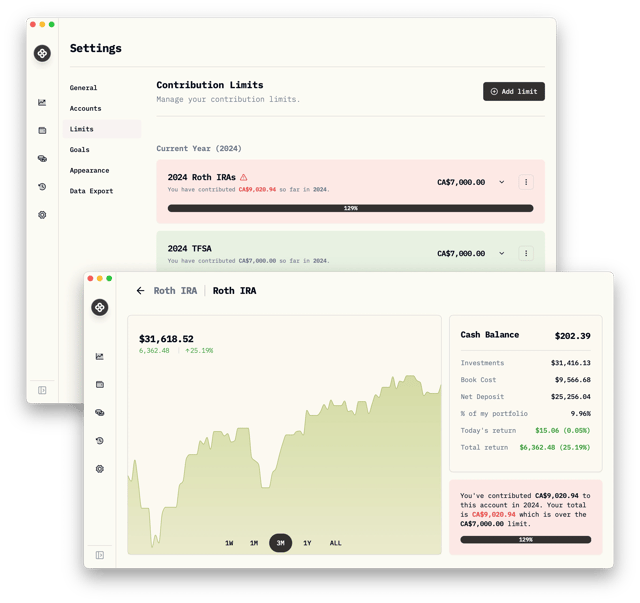

Investment Tracking

Track portfolio composition, performance, and analytics. Compare against benchmarks and see how your investments are really doing.

Net Worth Tracking

Get the full picture with assets and liabilities. Track your complete financial health in one place.

AI Assistant

Built-in AI to help you understand your portfolio, answer questions, and surface insights from your data.

Highlights

Your calm place to build wealth.

See everything. Move with intent.

Less manual work with

Wealthfolio Connect

Connect syncs your brokerages and keeps your Wealthfolio database in sync across devices.

Brokerage Sync

Automatically import accounts and transactions

Device Sync

E2E encrypted sync across all devices

Household View

Share selected portfolios with family

Extend with

powerful add-ons

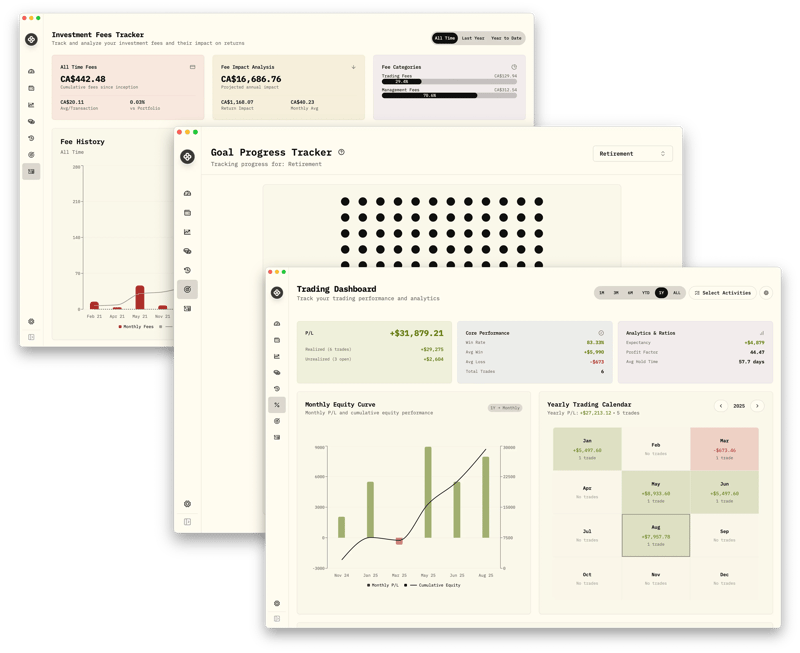

Investment Fees Tracker

Track and analyze investment fees across your portfolio with detailed analytics and insights

Goal Progress Tracker

Track your investment progress towards target amounts with a visual representation

Stock Trading Tracker

Simple swing stock trading tracker with performance analytics and calendar views